Remember that you can only cross out insurance costs if the total amount you're qualified to deduct goes beyond the standard deduction. However, hardly ever quantity to more than a pair thousand bucks a year. Because of this, you will typically require to have even more reductions, such as business costs, home mortgage passion or certain education and learning expenditures, to be eligible for itemized reductions.

If you're unsure about whether you're qualified to subtract your car insurance policy from your income tax obligations, consult an accountant or someone skilled in tax law. car. If you're doing your taxes using services like Turbo, Tax, the company will have on-call consumer service with qualified accounting professionals prepared to address your concerns.

Learn what a vehicle insurance policy deductible is and how it impacts your automobile insurance policy coverage. Car insurance policy all of us understand we require it. auto insurance. Beyond that, several of us still ask ourselves, "What auto insurance coverage should https://s3.ap-northeast-1.wasabisys.com/4-min-rule-best-credit-cards-for-car-rentals/index.html I get?" The secret is understanding what deductibles and coverages are and how they influence vehicle insurance.

What is an insurance deductible? Simply put, a deductible is the quantity that you accept compensate front when you make an insurance coverage claim, while the insurance provider pays the rest up to your coverage limitation. When selecting your automobile insurance policy deductible, consider just how much you agree to pay of pocket if you require to make a case (cheaper auto insurance).

It truly comes down to what makes you the most comfortable - insurance. Car insurance plan generally include a number of kinds of coverages. Due to the fact that insurance legislations differ from state to state, the complying with information is right here to provide you a wide summary of normal insurance coverages, and it isn't a statement of contract.

The 25-Second Trick For Comprehensive Car Insurance: Do You Need It? - Nerdwallet

cheap insurance low-cost auto insurance cheap car insurance accident

cheap insurance low-cost auto insurance cheap car insurance accident

Without insurance vehicle driver This insurance coverage pays for problems if you or another covered person is wounded in an auto accident triggered by a driver that does not have obligation insurance policy. In some states, it might also spend for home damage. The coverage varies by state as well as depends upon plan provisions. Uninsured driver coverage goes through a policy restriction picked by the guaranteed.

Underinsured driver protection is subject to a plan restricts selected by the insured. Rental reimbursement This protection pays for leasing expenditures if your cars and truck is disabled due to a covered loss.

When it comes to car insurance policy, an insurance deductible is the quantity you would certainly need to pay of pocket after a protected loss before your insurance coverage starts. Vehicle insurance deductibles function in a different way than clinical insurance policy deductibles with cars and truck insurance coverage, not all kinds of coverage need an insurance deductible. Responsibility insurance policy does not require a deductible, however detailed as well as collision insurance coverage usually do.

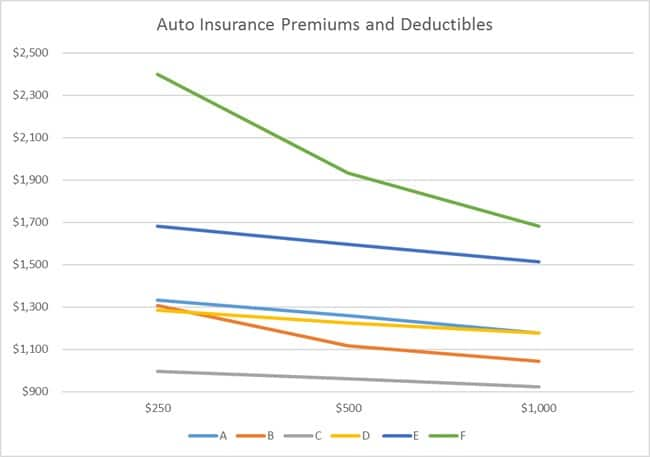

When you're including that protection to your cars and truck insurance plan, you'll typically have the possibility to decide where you intend to set the insurance deductible. Usually, the greater you set your insurance deductible, the lower your monthly insurance coverage premiums will be however you don't desire to set it so high that you would not have the ability to in fact pay that amount if required.

What does a vehicle insurance coverage deductible mean? A insurance deductible is the amount of cash you have to pay of pocket before your car insurance policy will cover the rest. If you backed your automobile right into a telephone post, your accident insurance coverage would certainly pay for the expense of the damage.

The smart Trick of What Is A Deductible? - Insurance Dictionary That Nobody is Discussing

If the total price of repairs concerns $1800, your insurance policy will just pay for $1300. You can locate your deductible quantities is listed on your declarations web page - insurance. Needing to pay an insurance deductible means you can do a kind of cost-benefit analysis prior to you make a case with your insurance company.

cheaper cheap car vehicle insurance low cost auto

cheaper cheap car vehicle insurance low cost auto

What kind of insurance coverage requires a deductible?, which covers the prices if you harm somebody's residential property or harm a person with your car, never ever calls for a deductible., and also where you set your insurance deductible will certainly have an affect on your regular monthly insurance costs.

The opposite is also true, selecting a reduced insurance deductible means you'll have to pay a greater premium. You may be attracted to select a high deductible in order to obtain a lower insurance coverage premium, yet bear in mind, there's an extremely actual possibility you'll need to pay that deductible at some point. When picking a deductible, ensure it's an amount you 'd actually have on hand if you required to pay it.

An auto insurance policy deductible is the amount you consent to pay out of pocket for a case before your policy pays the remainder. automobile. Maintain reviewing for more information concerning auto insurance policy deductibles, including: How a cars and truck insurance deductible works Some forms of car insurance coverage need you to pay a collection amount out of pocket prior to the plan covers the rest of the claim.

Our Comprehensive Auto Insurance Coverage - State Farm® Statements

The damage is covered under your crash insurance coverage, and also the fixings come out to $7,000. If you have a $500 deductible, you pay $500, after that your auto insurance provider pays the continuing to be $6,500. When do you pay an insurance deductible for auto insurance coverage? Not all sorts of vehicle insurance require you to pay a deductible.

: covers damage as a result of factors apart from collision, including theft, criminal damage as well as fire. An uninsured/underinsured driver insurance case might have a deductible, relying on where you live. Uninsured motorist protection deductibles often tend to be regulated by your state as opposed to you picking the quantity. Vehicle liability insurance policy covers problems and also injuries you create to various other people or their home.

Do I pay a deductible if I'm not at fault? If you are in an accident that is not your fault, you usually will not pay an insurance deductible.

If you need to speed up points up, sue with your insurance provider for accident insurance coverage. You will certainly require to pay your deductible in this circumstances, however if it's later on discovered that you're not to blame for the accident, you can get a reimbursement. There are a number of other opportunities that might happen: Your insurer might decide to go after action versus the other driver's company to redeem their costs. insurance.

If you are not able to recover your deductible from your company, you can take the various other driver to tiny cases court for the insurance deductible quantity. Maintain in mind, nevertheless, that the insurance deductible quantity might unworthy the moment. Car insurance policy deductible vs. superior Deductibles and costs are two sorts of payments you make to your vehicle insurance coverage company for protection.

What Should My Insurance Deductible Be? Can Be Fun For Anyone

How high should my deductible be? The higher your cars and truck insurance coverage deductible, the lower your costs will be.

cheap car insured auto affordable car insurance

cheap car insured auto affordable car insurance

If you have sufficient cash to cover a high insurance deductible in case of an insurance claim, you ought to go that path. This assists keep your yearly premium low and may potentially conserve you a whole lot of money in the long run, especially if you don't need to submit a case.

insurance cheaper car cheapest vehicle insurance

insurance cheaper car cheapest vehicle insurance

This is because the value of your cars and truck might be around what you would certainly need to pay of pocket in the occasion of a claim, making a high insurance deductible cost excessive. You can generally pick from a series of insurance deductible quantities. There are also some cars and truck insurance policies with no deductible, yet they're so pricey that they're commonly ineffective.

Our very own research shows that there isn't a considerable effect on your costs once you transcend a $750 deductible, so consider keeping your insurance deductible quantity in between $500 as well as $1,000. It needs to be noted that if you fund or lease your automobile, you may not have an option in the deductible on your cars and truck insurance plan.

LLC has actually striven to make sure that the information on this site is appropriate, but we can not assure that it is free of mistakes, mistakes, or omissions. All material as well as solutions offered on or through this website are offered "as is" as well as "as available" for use (accident). Quote, Wizard. com LLC makes no depictions or guarantees of any type of kind, express or suggested, as to the procedure of this website or to the information, web content, materials, or products consisted of on this site.

How When Is Car Insurance Tax-deductible? - Valuepenguin can Save You Time, Stress, and Money.

You're responsible for the very first $1,000 of problems and your insurance provider is in charge of the other $1,000 of covered damages. affordable car insurance. Collision and also extensive are both most typical insurance coverages with an insurance deductible. Crash-- this insurance coverage assists pay for damages to your automobile if it strikes one more vehicle or item or is hit by one more auto.

There are no deductibles for obligation insurance policy, the coverage that pays the various other person when you trigger a mishap. Vehicle insurance policy deductibles use to each accident you're in.

Talk with your Traveler's agent or independent representative, regarding the ideal method to cover your lorry. What is a Vehicle Insurance Deductible? Your automobile insurance deductible is the amount you'll be in charge of paying in the direction of the prices due to a loss before your insurance policy coverage pays. The lower the deductible, the less you'll pay of pocket if an incident occurs.

Picking a higher insurance deductible may reduce your automobile insurance policy premium (cars). It is important to select an insurance deductible you can manage in the event of a loss. Speak to your neighborhood independent representative or Travelers representative regarding the deductible alternatives readily available to you. When Do You Pay an Auto Insurance Policy Deductible? Anytime you most likely to your very own insurance provider to sue for damages to your covered automobile, an insurance deductible will apply whether you are at mistake or not.

What Are Liability Limitations as well as Just How Do They Function? Your cars and truck insurance responsibility protection restrictions, likewise referred to as limit of responsibility, are the most your insurance policy will pay to another celebration if you are lawfully liable for a mishap. Umbrella plans are not required as well as readily available coverage restrictions as well as qualification demands may differ by state (auto insurance).

What is an automobile insurance policy deductible? The insurance deductible is the dollar amount "subtracted" from an insured loss. Simply put, the insurance deductible is the amount that a person need to pay out of pocket for repair services or substitute after a mishap. : let's state you are in a fender bender, the overall cost of repair work is $1,000, and your insurance firm pays $800. cars.

1 For several consumers, figuring out just how much of a deductible to take can be a difficult choice. How does an auto insurance policy deductible work? Traditional auto insurance plans typically need the customer to choose one deductible for extensive protection, as well as a different deductible for collision protection, although they may coincide deductible amount (affordable auto insurance).

Any insurance claim you declare damage that is covered by crash will be subject to an accident deductible. 1 The higher an insurance deductible, the lower the annual, biannual or monthly insurance policy premiums might be because the customer is presuming a part of the total price of a claim. Keep in mind that the insurance deductible quantity will certainly come out of the policyholder's pocket in case of an at-fault cars and truck crash, which might outweigh the costs financial savings.

If the policyholder does not have an at-fault crash causing a claim, the individual has actually paid more for car insurance than somebody with a higher deductible. When do you pay the deductible for automobile insurance policy? A much better concern may be, when do you not have to pay the car insurance deductible? Most of the times you're on the hook for it, however if you're in an accident which an additional vehicle driver is at fault for, this is not the situation. cheap car insurance.

The smart Trick of Automobile Insurance Information Guide That Nobody is Talking About

This is just the instance as long as the prices drop within the variety of the insurance coverage you acquired, however (insure). A lessening insurance deductible may inevitably lead to a minimized deductible or also none at all. This type of insurance deductible benefits drivers for preventing mishaps by lowering their insurance deductible annually they stay accident-free.

A high deductible will certainly lower your general insurance policy price, however it will increase your out-of-pocket costs if you sue. 1 5 inquiries to help you pick the best car insurance policy deductible In figuring out the right deductibles, below are five questions to think about before making the choice: How do various insurance deductible degrees affect the insurance policy premium? This is a great concern as no two insurance provider will have the same deductible-premium ratio, and states vary on their regulative strategy to the subject.